What Marketers Need to Know About Three Core Financial Statements

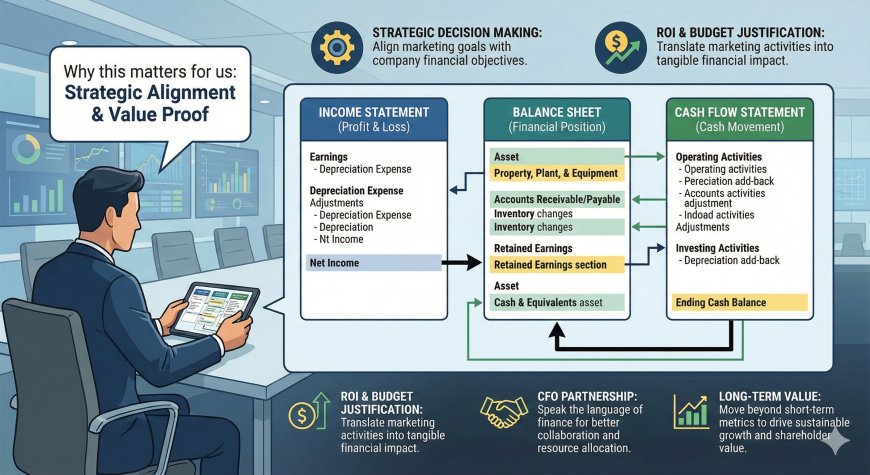

The number one tension in the board room is financial literacy when it comes to marketers. Core financial statements like the P&L, Balance Sheet and the Cash Flow Statements are crucial for the health of the business. P&L is how you are growing, Balance Sheet is if this growth is effective and the cash flow statement is how survivable all of this is. Understanding how they interact for marketers is important when it comes to articulating that marketing is CapEx like an investment and not OpEx like a write off. It should be top of mind for every CMO that wants to take that seat at the board and lead the conversations.

There are three core financial statements for a SaaS company – P&L, Balance Sheet, and Cash Flow.

All three are crucial and they are all connected. They feed off each other to show the health of the business – how good you are selling, how effective your GTM is, how well you are managing assets vs liabilities, how costly it is to acquire a customer, how health your retention metrics are.

I was looking for a CMO friendly way to explain these and how they interact. I think, being able to speak the same language as the rest of the C suite doesn’t only allow the CMO to sit at the table but ensures she is running the conversation – this is bound to increase the tenures that are currently not very enticing.

Below is what I came up with:

1- P&L – How well are you selling?

This is an income statement, covers a period; month, quarter, etc…

It shows you:

·

If the GTM investment is efficient

· Whether CAC is too high

· If margins are shrinking

· How scalable the business is

Marketing analogy:

It’s like your weekly campaign performance report: impressions, cost, conversions, ROAS → net result.

2- Balance Sheet – What you own, owe and invested?

This covers a snapshot of a time – like the picture you take at a certain moment.

It tells you assets, liabilities and equity.

· Assets – what you own

· Liabilities – what you owe

· Equity – what is left for the shareholders

Marketing analogy:

It’s like the "state of your brand assets": audience size, email list, brand equity (except for money.)

3- Cash Flow Statement – Do you actually have cash?

This matters because you can be profitable on the P&L and still run out of cash.

This covers a period; month/quarter/year

· Operating activities (customers paying, vendors paid)

· Investing activities (buying equipment, R&D, software capitalization)

· Financing activities (loans, equity raises)

Marketing analogy:

It’s like having tons of leads but terrible pipeline conversion. It looks great on surface, but you can't pay salaries with MQLs.

So how do these look in practicality in terms that marketing teams can understand:

1- You run a paid ads campaign

· Revenue from new customers appears on the P&L

· If customers pay later (Net-30), it hits Accounts Receivable on the Balance Sheet

· When they finally pay, cash moves through the Cash Flow Statement

2- You sign a big annual contract, paid upfront

· P&L: You only recognize a portion of revenue each month

· Balance Sheet: Cash goes up immediately; Deferred Revenue (a liability) also goes up

· Cash Flow: Huge inflow in financing operations → saves you from a cash crunch

3- You hire a big marketing team or agency

· P&L: Expenses recorded monthly

· Balance Sheet: If you owe invoices, Accounts Payable increases

· Cash Flow: When invoices are paid, cash leaves

P&L → feeds the Balance Sheet → Cash Flow explains changes in both.

So, when you are in front of you CFO the next time, you can speak the same language and even give how marketing frames these.

You can articulate that marketing is a multiplier – it amplifies all other functions. It should be treated as CapEx like an investment and not OpEx like an operating expense.

GTM is nonlinear, highly probabilistic and has a time lag. It needs to be measured with causal frameworks that feed into all of these core financial statements.

Framing this in a manner that focuses on the bottom line provides the credibility that any smart CMO deserves.

I assure you; your CFO will be impressed!